Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

IRS Form 2290

If you are a trucker having a vehicle whose taxable gross weight is 55,000 pounds or more, then you need to e-file HVUT Form 2290 for getting the stamped copy of your Form 2290 Schedule 1. You need to e-file for any taxable highway motor vehicles which are registered in your name under the state, District of Columbia, Canadian or Mexican law, when it is used for the first time in a tax period.

For filing Form 2290 online, you must have the details of your business including address, business name, EIN and even the details of the authorized signatory. Also, you will need the details of the vehicle including the gross taxable weight and VIN (Vehicle Identification Number).

Reasons to file Form 2290 amendments

Form 2290 Correction is used to correct the errors present in the original 2290 submissions. Whenever the information of the vehicle changes, then it is mandatory by the IRS to file the amendments for the original Form 2290.

There are three major kinds of amendments for which you need to file Form 2290 Correction

VIN Correction

A VIN Correction happens when the submitted 2290 has certain errors with regard to the vehicle identification number. Now as the VINs are quite long, it is understandable that you might make mistakes and even correct them. Now VIN Corrections can be only done for suspended or taxable vehicles and not for the credit vehicles or for the ones which are suspended vehicles.

Tax From Increasing The Taxable Gross Weight

If the taxable gross weight of a vehicle increases in a given period and the vehicle falls in a new category, you need to file Form 2290 Correction. For example, if the maximum load to be carried increases, it will change the taxable gross weight. In such situation, Form 2290 Correction needs to be filed on the last day of the month followed by the month in which the taxable gross weight has increased.

Suspended Vehicle Exceeds The Mileage Use Limit

The mileage use limit for any heavy vehicle present on the public highway is 5,000 miles or less (7,500 miles with regard to agricultural vehicles). This mileage use limit is applicable to the total mileage of the vehicle on the road during a given period, irrespective of the numbers of owners.

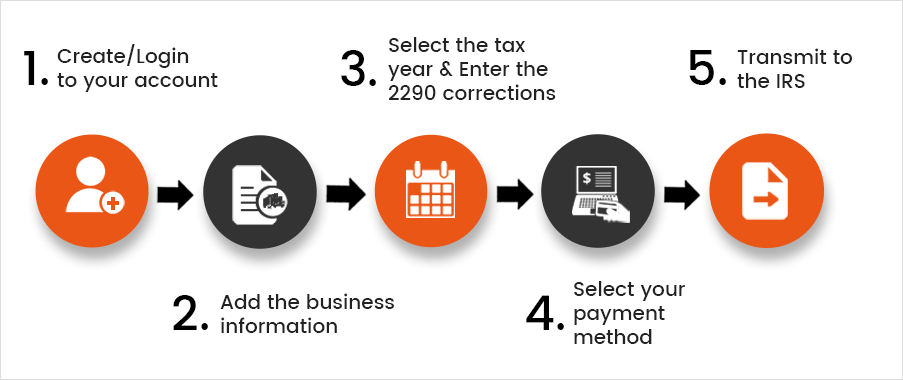

Steps to E-file

Create/Login to your account

Add the business information

Select the tax year

Enter the 2290 corrections (VIN Correction / Gross Weight Increase / Mileage Exceed)

Select your payment method

Transmit to the IRS

Features

Free 2290 VIN Correction

Sometimes you might accidentally enter the wrong VIN number while filing. You can e-file VIN Correction to rectify it.

Save 10% with Prepaid Credits

By purchasing prepaid credit using the Wallet System, you can get about 10% or more discount on the Form 2290 filing fees. Now, these credits won’t expire and it will be stored in the Wallet.

Copy Last Year’s Return

Simply select to copy your return from the previous year and all the given information will be easily copied to your current return. The best part is that you won’t need to re-enter any single information.